owe state taxes illinois

That makes it relatively easy to predict the income tax you. The state of Illinois has a flat.

Illinois Taxpayers Could Be Entitled To Refunds Of 840 Or More Due To 2018 Taxes Are You One Of Them Gobankingrates

Taxpayers who owe delinquent income taxes to the State of Illinois have four standard options available to reach a reasonable resolution.

. While the 24 federal tax. If you dont already have a MyTax Illinois account click here. Answers others found helpful What do I have to do to get an extension for individual income.

You can learn more about how the Illinois income tax compares to other states income taxes by visiting our map of income taxes by state. The Comptrollers Office may offset any money that the Illinois state government owes you and apply that amount to your delinquent tax liability. Federal and state tax laws and rates are not the same.

Credit Card Check or money order follow the. The late-payment penalty amount is based on the number of days the payment is late. It is possible to owe Illinois and receive a refund from the IRS.

For 2022 the top ie 37 federal income tax bracket applies to single filers who have more than 539900 in income and joint filers with income over 647850. Does Illinois have a standard deduction for individual tax filers like the. June 3 2019 1116 AM.

MyTax Illinois If you have an MyTax Illinois account click here and log in. The default length for a tax payment plan in Illinois is. If you are required to file a federal tax return you are required to file an Illinois tax return even if you owe.

Your employer will withhold money from each of your paychecks to go toward your Illinois state. A late-payment penalty for tax not paid by the original due date of the return. On the state level you can claim allowances for Illinois state income taxes on Form IL-W-4.

The state of Illinois is providing an individual income tax rebate in the amount of 5000 per person 10000 per couple for married filing jointly and 10000 per dependent limit of. Illinois is saying I owe them state taxes but I didnt live or work there The Illinois Federal State Exchange is saying I owe them 10k in back taxes for not filing in 2017 and 2018. If the winner opts to take the full 1 billion in winnings over 30 years they will receive annual payouts of 333 million on average before taxes.

For non-retirees calculating Illinois income tax is fairly easy as the state has a flat tax of 495 that applies to everyone regardless of income. You can figure out what your take. The automated system can tell you if and when the state will issue your refund.

The number is 1-800-323-4400 or 609-826. Ad Do You Need To Set Up An Illinois State Installment Plan. 1 Best answer.

Installment Payment Plan An. It is possible to owe Illinois taxes and get a refund from your federal return in the same year. Yes the Illinois Department of Revenue allows those who cannot pay tax debts due to financial hardship to make installment payments.

We may ask the Internal Revenue Service to. Payments less than 31 days late are penalized at 2 of the amount due and payments 31 days late are. Taxpayers who fail to pay state taxes owed to the State of Illinois will incur interest charges.

The state of Illinois has a flat income tax which means that everyone regardless of income is taxed at the same rate. The Illinois income tax was lowered from 5 to. It cannot give you information on amended returns.

The DOR assesses interest the day after the taxpayers payment due date until the date the taxpayer. You owe Illinois Use Tax if you purchase an item for use or consumption in Illinois from an out-of-state retailer who charges no Illinois Sales Tax or charges sales tax at a rate lower than the.

Illinois Tax Rates Rankings Illinois State Taxes Tax Foundation

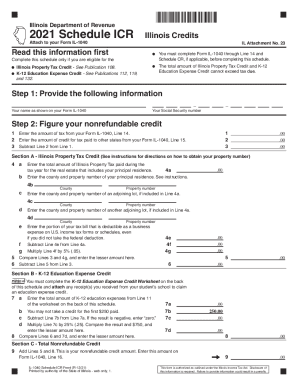

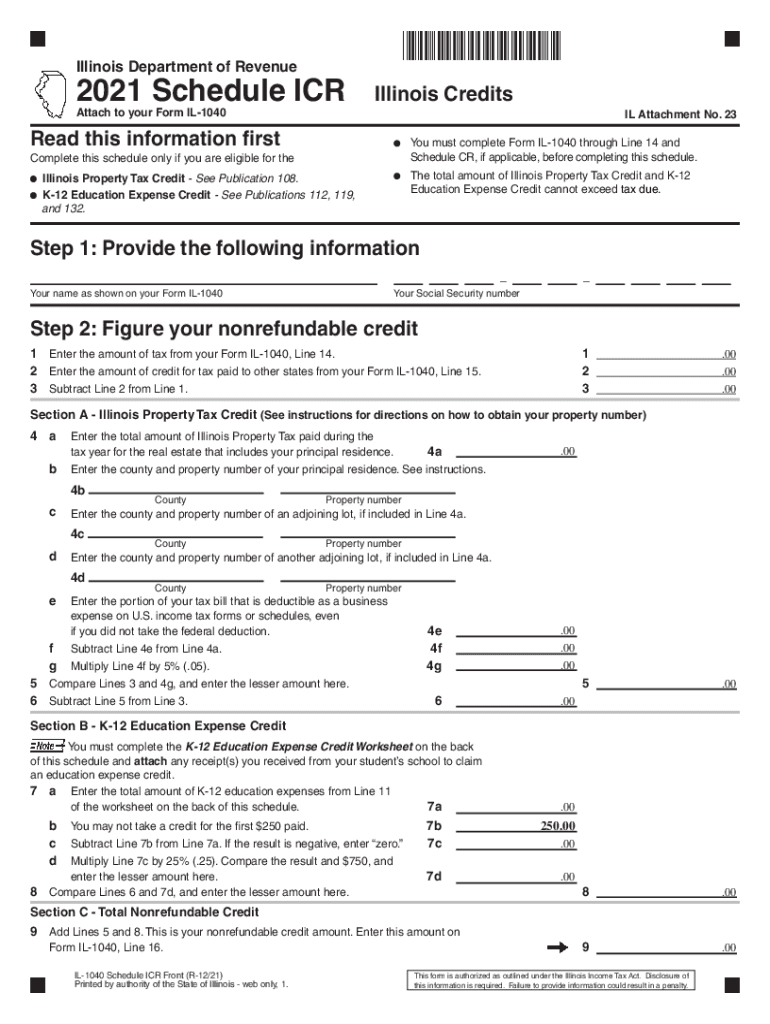

2021 Form Il Il 1040 Schedule Icr Fill Online Printable Fillable Blank Pdffiller

Illinois State Tax Software Preparation And E File On Freetaxusa

How To File And Pay Illinois Sales Tax Youtube

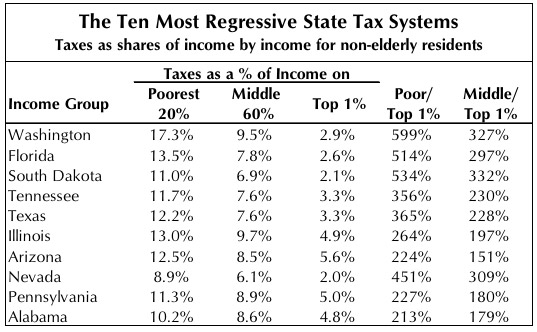

Illinois Taxes The High The Low And The Unequal Chicago Magazine

Where S My Refund Illinois H R Block

2021 Form Il Il 1040 Schedule Icr Fill Online Printable Fillable Blank Pdffiller

Illinois 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Illinois Income Tax Calculator Smartasset

Federal And State Tax Information Warren Newport Public Library

How Illinois Income Tax Stacks Up Nationally For Earners Making 100k Center For Illinois Politics

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What S The Difference

Mega Millions Jackpot How Much Will Illinois Winner Owe In Taxes

Illinois State Offer In Compromise Overview For Income Taxes

Graduated Income Tax Proposal Part Ii A Guide To The Illinois Plan The Civic Federation

Retirees Need To Take Action For Latest Property Tax Rebate Npr Illinois

Illinois Mega Millions Winner Third Largest U S Lottery Jackpot Ever

Reciprocal Agreements By State What Is Tax Reciprocity

Taxing The Poor Through Real Estate Transfers University Of Illinois Law Review